About 1031 Exchanges by IREXA Financial Services

1031 Exchanges

- Defer Tax Liabilities to a More Opportune Time

- Keep Investment Dollars Fully Invested

- In Many Cases Improve Upon The Grade and Quality Of Holdings

Characteristic of a 1031 Exchange

A tax-deferred exchange is a transaction involving the sale and purchase of investment property or property held for productive use in a trade or business which meets requirements of Section 1031 of the Internal Revenue Code and qualifies for non-recognition of gain or loss. Technically, the exchange is tax-deferred, not tax-free, since the gain deferred in the transaction will be recognized on the ultimate sale of the replacement property received in the Exchange. During a tax-deferred exchange, the investor may not have constructive receipt of their exchange funds. Therefore, a Qualified Intermediary (QI) as an independent third party is needed to facilitate a 1031 Exchange transaction and hold the funds on behalf of the investor.

Exchange Structure

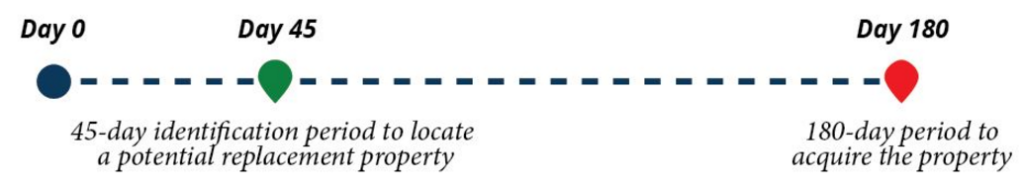

When structuring an Exchange, there are two critical time limitations that begin on the day the original property is sold. They are:

It is important to note that the identification period and the closing period do run concurrently, and make no concession for weekends and holidays.

In addition to the time limitations when completing an Exchange, investors must also consider the value requirement. There is a general rule of thumb used in order to meet the exchange value requirement for full deferral treatment:

“ANY CASH RECEIVED PLUS DEBT RELIEVED FROM THE RELINQUISHED PROPERTY MUST BE REINVESTED INTO THE REPLACEMENT PROPERTY.”

The only exception to the above is with the investment of new cash to replace any or all of the debt relieved. Additional debt, while allowed when acquiring a replacement property, does not get an exchanger to the value requirement if cash is withdrawn from the transaction.