A married couple in their mid-forties approached me to have a financial analysis based on my Strategic Tax Mitigation™ protocol. Their chief concerns included: the lack of strategies they had to reduce their current taxes and to develop a better retirement income program. After the review, I developed a plan to meet the clients’ goals and objectives.

- The clients currently generate approximately $467,000 annual income.

- The clients each have older Variable Universal Life (VUL) Insurance policy

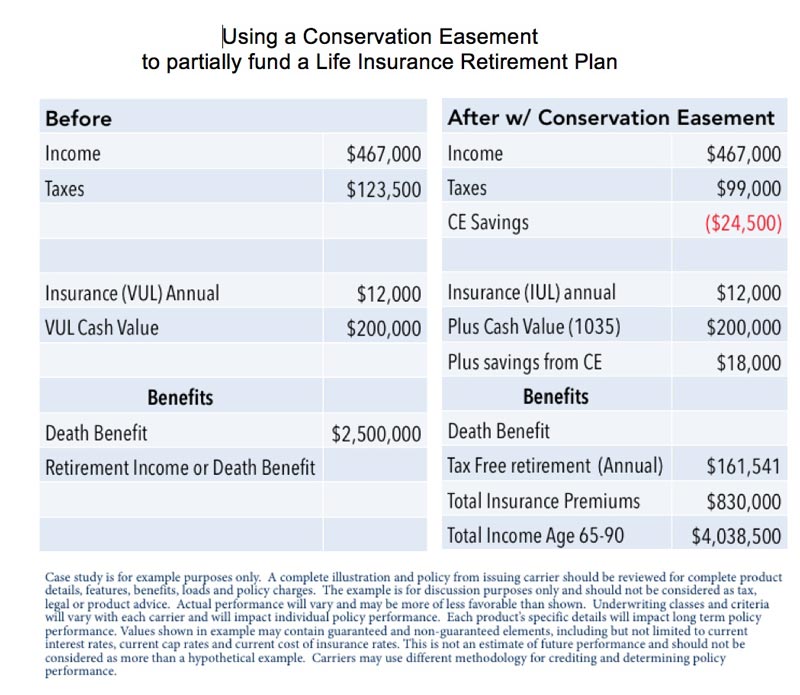

With regards to income, a Charitable Contribution of a Conservation Easement (IRC § 170h) could be used to reduce taxes due to Ordinary Income (see Conservation Easement case study). In this couple’s case, a tax savings of approximately $24,500/yr could be achieved. Using this strategy, their taxes could be reduced from $123,500 to $99,000 in the proposal year.

With regards to their life insurance policies, Variable Universal Life policies follow the market. Cash values in the policy can go up or down depending on the direction of the market. When I explained the volatility issues the clients also became concerned. The policies were out of date and didn’t meet the clients’ desire for creating additional income in retirement.

The following proposal was made:

Generate tax savings from the use of the conservation easement, then redeploy the savings to invest in a better life insurance policy. The tax savings from the Conservation Easement could be used to help create a life insurance policy more aligned with the clients’ goals and objectives.

The existing VUL insurance policy was converted into an Indexed Universal Life (IUL) insurance policy by using a IRC § 1035 exchange. The clients were lawfully able to make this exchange without paying taxes. The two VUL policies had a cash value of approximately $200,000. The annual $12,000 premium for both clients was increased by $18,000 for a total of $30,000/yr, using most of the annual savings from the Conservation Easement. The CE acquisition and tax savings is repeated annually. As long as the couple’s income stays above $400,000, the new life insurance policy should be fundable from the Conservation Easement savings, with no additional money from the clients.

Through the Indexed Universal Life policies, the clients may be able to create $161,541 per year tax-free retirement income for 25 years (65 to 90). The total cost of the policies is $830,000. If the clients survive for just over 5 years into retirement, they will have gotten their money back. If the clients live long enough to use all of the tax-free income available in the policy, they should be able to withdraw over $4,038,500, or nearly 5 times their cost.

As with any tax strategy, clients should consult with their tax professional. Neither IREXA, LLC nor Great Point Capital are attorneys or tax professionals. All work regarding Strategic Tax Mitigation™ relies on the client’s tax professional. This example was in accordance of the applicable laws at the time of the transaction.