Using charitable contributions of a conservation easement, A Charitable Contribution of a Conservation Easement (CE) IRC § 170(h), may be used to mitigate taxes due to ordinary income. IRC § 170 (h) allows users to make contributions for charitable purposes that result in a reduction in tax liability.

A CE can occur when a property owner gives up a viable right (such as a development, or a mineral right, etc.) associated with a property in perpetuity, via easement, that is monitored by an NGO or government entity, as long as it creates a public benefit.

The CE is structured as a real estate investment that has three operational and exit strategies one of which is voted to be the strategy that will be used by the investors. Generally, the strategies are: hold the property for appreciation, develop the property to its highest and best use, or create a Conservation Easement.

To determine the value of the conservation easement, two MAI appraisals of the subject property, meeting specific governmental criteria, are completed: the first appraisal is the before condition of the property’s highest and best use, the second is the after condition of the property’s highest and best use. The difference in value between the first and second appraisal may provide a tax deduction to the investor.

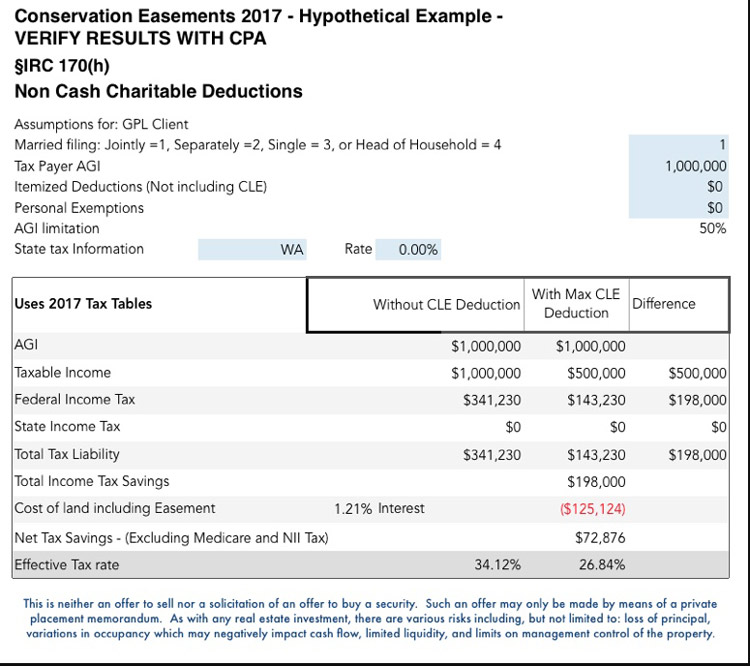

The tax benefits generated by a Conservation Easement are limited to 50% of adjusted gross income (AGI). Historically, the economics of a CE are such that for a $1 contribution into the CE, an investor’s income is reduced by approximately $4.00. At a 39.6% tax rate, for every $1 contributed, the investor’s taxes may be reduced by approximately $1.60.

It should be noted the IRS is aware that Conservation Easements are subject to abuse because of the tax benefits received. The IRS put forth Notice 2017-10 January 23, 2017 to address these issues. CEs are now listed transactions. In the event the deduction is equal or greater than 250% of the amount invested, they are subject to further scrutiny and potential audit as being abusive. The CEs referenced in this case study have a deduction of approximately 1.6 to 1. Furthermore, in an abundance of caution, the sponsor has recently sought to get tax loss insurance on all CEs going forward. They have been successful in obtaining that insurance for all CEs since that decision.

As with any tax strategy, clients should consult with their tax professional. Neither IREXA, LLC nor Great Point Capital are attorneys or tax professionals. All work regarding Strategic Tax Mitigation™ relies on collaboration with a tax professional.

This example was in accordance of the applicable laws at the time of the transaction. The maximum deduction taken via Conservation Easement reduced the effective tax rate from 34.12% to 26.84%, a savings of $198,000 in federal taxes.

*IRS tax code is subject to change and the IRS could disallow some or all of the benefits discussed above. The above numbers are for specific cases. Past performance is not guaranteed.

IREXA® Financial Services / Wealth Strategies collaborates with CPAs, attorneys, and other tax planning professionals to assist clients with tax mitigation strategies. IREXA® and Great Point Capital, LLC are not tax professionals or attorneys. IREXA® only provides client tax mitigation strategies through, and with the approval of, the client’s professional counsel. You should review any planned financial transaction that may have tax or legal implications with your personal tax or legal representatives or advisors.

Securities offered through Great Point Capital, LLC, Member FINRA/SIPC, 200 W Jackson Blvd #1000, Chicago, IL 60606, telephone (312) 356-4872. IREXA® Financial Services / Wealth Strategies is not affiliated with Great Point Capital, LLC